Capital Raising

OPEN

Sydney Metro Fund

A Better Way To Invest

INDUSTRY

Managed Fund

RAISING

Open

OFFER PRICE

A$1.00 per unit

MINIMUM INVESTMENT

A$50,000

Investment Highlights

Company Overview

Products & Services

Transaction Overview

Additional Information

Team

News

Transaction Summary

Sydney Metro Fund

Raising A$2M

via Convertible Note

Discount to Series A

Investment Highlights

Exposure to a portfolio of diverse business credit loans

Exclusive opportunities for wholesale and sophisticated investors

Higher yields than available with retail deposit products, targeting 6.25% over RBA Cash Rate

Fund size currrently A$11M

Company Overview

The Sydney Metro Fund (the Fund) is a pooled mortgage fund that offers Australian sophisticated investors the opportunity to gain exposure to a portfolio of loans.

The Fund offers Australian wholesale and professional investors the opportunity to gain exposure to a portfolio of loans comprised of:

Loans secured predominantly by registered first or second mortgages; and Loans to businesses that are not secured by real property Mortgages, will be secured by other forms of security, including general security agreements and directors’ guarantees.

Loans will only be made for use for commercial and business purposes and will not be made for consumer purposes.

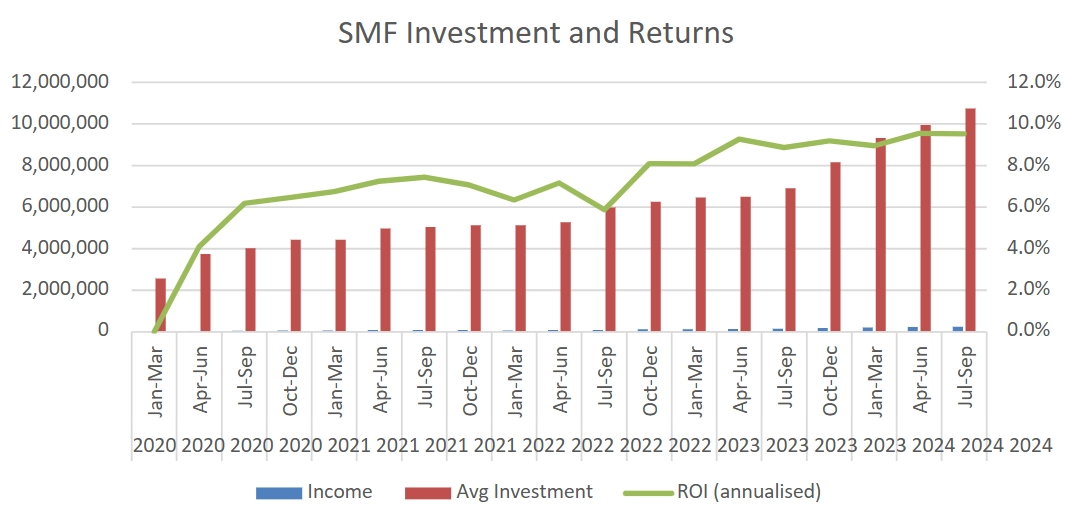

The investment return objectives of the Fund are to provide investors with regular income distributions and a target average total return equal to the Reserve Bank of Australia cash rate plus 6.25% per annum (this includes both income and capital returns and is annualised after all fees and costs but before tax).

The Manager

The Fund is professionally managed by Sydney Metro Properties Pty Ltd, an independent investment manager with substantial experience managing a wide variety of property assets including, residential, commercial and industrial. The Manager also has substantial experience in the lending market place having secured and/or placed hundreds of millions in debt financing.

The Trustee

Recent Results

Investors

The fund currently (as at February 2025) has 12 investors with an average subscription ranging from $200,000 to $1,800,000 invested, with the trustee/manager being the largest investor in the fund.

These investors include Self Managed Superannuation Funds as well as High Net Worth Personal Investors, and are all long term investors - some of whom choose to receive quarterly distributions and some of whom choose to roll over the distributions into their investments quarterly.

At present, the Fund is experiencing a high level of enquiries for potential loans – and are seeking further investment funds accordingly.

Webinar Presentation

Products & Services

Stronger Returns with Regular Income

Sydney Metro Fund’s regular income-producing fund may be suitable for self-managed superannuation funds (SMSF) and self-directed investors who seek returns higher than they can expect in retail deposit investments. Sydney Metro Fund was created to service two growing markets and their distinct needs:

- Businesses, that need tailored private debt financing;

- Investors who are looking for fixed-interest investments, with yields greater than those available through term deposits and other retail offerings.

Sydney Metro Fund services both the borrowing and investment markets. It does this with an astute approach to business financing outside the Consumer Credit Code, and a structured investment facility with strong yields and low risk. It is intended that the Fund will distribute monthly, however, distributions are not guaranteed.

The Fund is designed and aimed to serve

The needs of self-directed investors, self-managed superannuation funds and self-funded retirees

Investors who require predictable income distributions from long term investments

Investors who do not want their distributions negated by inflation and fees.

Transaction Overview

The Fund’s minimum investment is $200,000 and the manager only accepts Wholesale Investors as defined by s.7 of the Corporations Act. That means the Fund accepts investors who can invest at least AUD$500,000, and who meet the minimum asset requirement (AUD$2.5 million net assets) or income (AUD$250,000 of gross income for the last two financial years), or investors who fulfill the legislative definitions of a Professional Investor.

We urge investors to see their financial and taxation adviser before committing to any investment, and we ask prospective investors to read the Information Memorandum in full before making a decision.

The manager has the absolute discretion to accept investments of less than the minimum investment amount of A$200,000

General Disclaimer

The content on this site is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. This site is intended for Accredited/Sophisticated/Wholesale investors only. By continuing with an investment, you are self-accrediting that you so qualify. To the extent permitted by law, neither PrimaryMarkets, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment opportunities on this site and any statements made about them by their issuers are not vetted or verified by PrimaryMarkets. Investing in securities in private or unlisted companies and Funds is speculative and involves a high degree of risk. The investor must be prepared to withstand a total loss of their investment. We strongly encourage the investor to seek independent financial, professional or investment advice before investing in securities. The presence of an investment opportunities on this site should not be interpreted as an implied endorsement of it by PrimaryMarkets. Some content provided may constitute a summary or extract of another document. Past performance does not necessarily indicate future performance. The content on this site was current as at date of initial publication but may not be current as at the date of your viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

Want to learn more?

Fill in the expression of interest form below