Investor Hub

Sydney Metro Fund

A Better Way to Invest

INDUSTRY

Managed Funds

STATUS

Closed

OPEN TO

Wholesale Investors

Investment Highlights

Company Overview

The Sydney Metro Fund (the Fund) is a pooled mortgage fund that offers sophisticated Australian investors the opportunity to gain exposure to a portfolio of loans.

The Fund offers Australian wholesale and professional investors the opportunity to gain exposure to a portfolio of loans comprised of:

Loans secured predominantly by registered first or second mortgages; and Loans to businesses that are not secured by real property Mortgages will be secured by other forms of security, including general security agreements and directors’ guarantees.

Loans will only be made for use for commercial and business purposes and will not be made for consumer purposes.

The investment return objective of the Fund is to provide investors with regular income distributions and a target average total return equal to the Reserve Bank of Australia cash rate plus 6.25% per annum (this includes both income and capital returns and is annualised after all fees and costs but before tax).

The Manager

The Fund is professionally managed by Sydney Metro Properties Pty Ltd, an independent investment manager with substantial experience managing a wide variety of property assets including, residential, commercial and industrial. The Manager also has substantial experience in the lending market place having secured and/or placed hundreds of millions in debt financing.

The Trustee

Sydney Metro Properties Pty Ltd – as the holder of Australian Financial Services License No. 544582 – is also the Trustee of the Fund and provides Registration and Administration services – ensuring that the Fund functions efficiently and profitably for all of its investors.

Recent Results

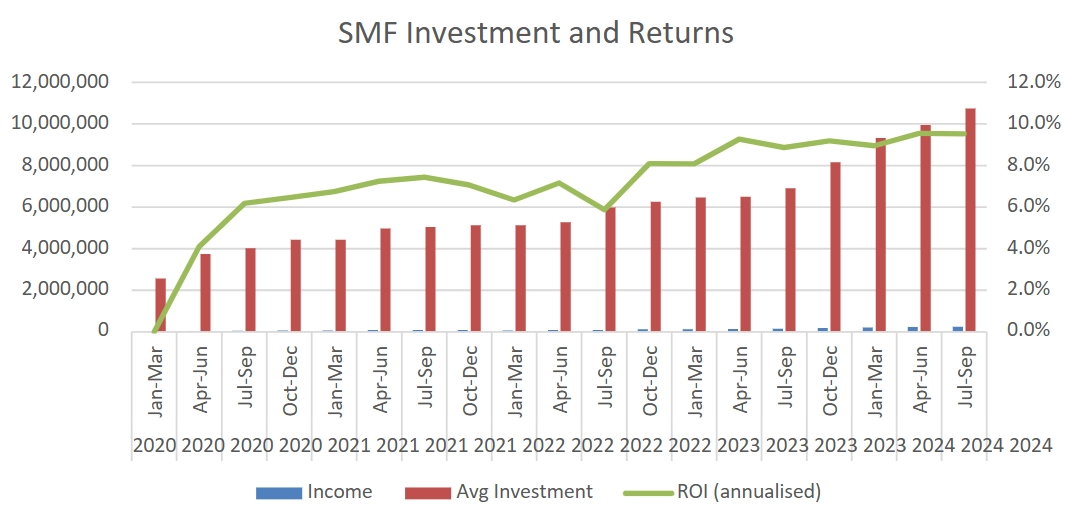

The chart below shows annualised returns to investors by quarter – since the inception of the fund in 2020 – showing growth in both Investments (400%) and Return on Investments from initially 4.1% to currently 9.5%. Note also that they are projecting the April – June 2025 quarter to show an annualised ROI of over 10%.

Investors

The fund currently (as at February 2025) has 15 investors with an average subscription ranging from $200,000 to $1,800,000 invested, with the trustee/manager being the largest investor in the fund.

These investors include Self Managed Superannuation Funds as well as High Net Worth Personal Investors, and are all long term investors - some of whom choose to receive quarterly distributions and some of whom choose to roll over the distributions into their investments quarterly.

At present, the Fund is experiencing a high level of enquiries for potential loans – and are seeking further investment funds accordingly.

Products & Services

Stronger Returns with Regular Income

Sydney Metro Fund’s regular income-producing fund may be suitable for self-managed superannuation funds (SMSF) and self-directed investors who seek returns higher than they can expect in retail deposit investments. Sydney Metro Fund was created to service two growing markets and their distinct needs:

- Businesses that need tailored private debt financing;

- Investors looking for fixed-interest investments with yields greater than those available through term deposits and other retail offerings.

Sydney Metro Fund services both the borrowing and investment markets. It does this with an astute approach to business financing outside the Consumer Credit Code, and a structured investment facility with strong yields and low risk. It is intended that the Fund will distribute monthly, however, distributions are not guaranteed.

The Fund is designed and aimed to serve |

|---|

The needs of self-directed investors, self-managed superannuation funds and self-funded retirees |

Investors who require predictable income distributions from long term investments |

Investors who do not want their distributions negated by inflation and fees. |