Capital Raising

OPEN

Anadara

Strategic Yielding Notes

INDUSTRY

Structured Notes

RAISING

Uncapped

MINIMUM INVESTMENT

A$50,000

Investment Highlights

Company Overview

Additional Information

Transaction Summary

Anadara

Strategic Yielding Notes

Minimum Investment $50,000

For Wholesale Investors Only

Investment Highlights

Guaranteed double digit coupon paid monthly

Equity linked investment to ASX50, SP500 Stocks or Bitcoin

Investment Term: 6 – 12 months

Investment is available in AUD or USD

For Wholesale Investors Only

Company Overview

Anadara is a specialty fund manager and structured investment issuer with offices in Australia and Singapore. Anadara creates and issues highly customised investment products for institutions, family offices, private wealth advisers and now high net worth individuals in Australia - these types of investments have not previously been available to the market generally, as access to investment products like these required institutional grade agreements with large global investment banks, that generally require large balance sheets and significant trading volume to access.

These types of investments have been a key to institutional investors' success over the last 30 years, and Anadara is leveraging its experience and partnerships with multiple global investment banks to bring these investment products to wholesale investors and advisors in Australia. Anadara’s range of investments can be tailored to suit any market condition through its capital protected, enhanced yield and leveraged tax effective investments.

Anadara is pleased to offer a choice of enhanced yield investments for Wholesale Investors via Primary Markets. These investments, Strategic Yielding Notes, feature double digit coupons that are guaranteed and paid monthly and are linked to either ASX50, SP500 stocks, or Bitcoin. These investments are designed for both fixed income investors that are seeking a higher level of yield in exchange for a predefined level of risk and equity investors that would like to be invested in the market but fear the market will pull back.

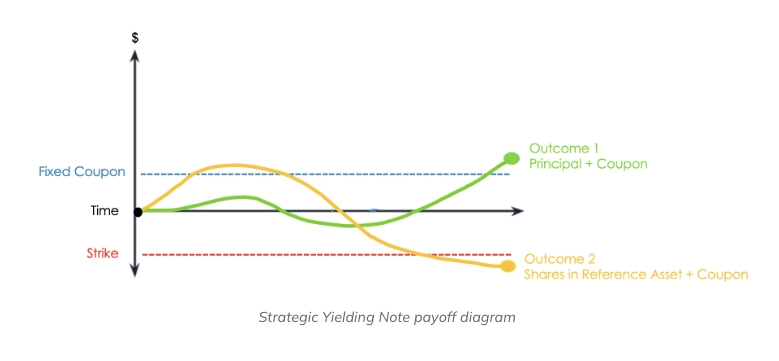

Strategic Yielding Notes generate regular income and at maturity, the investor either receives their principal investment back as cash or shares in the underlying stock at a discount, referred to as the Strike, which is presented as a percentage of the underlying stock’s price on the investment’s commencement date – if the underlying stock(s) are trading above the Strike on the maturity date, the investor receives their investment back as cash. If the underlying stock(s) is trading below the Strike, the investor’s principal investment is used to buy the stock at the Strike price.

Anadara has created a choice of three Strategic Yielding Notes for investors to choose from; one linked to ASX Mining Companies (AUD), one linked to US Tech Stocks (USD), and one linked to Bitcoin (USD). A summary of each investment follows:

ASX MINING NOTES | US TECH NOTES | BITCOIN NOTES | |

|---|---|---|---|

Fixed Coupon (paid monthly) | 12% per annum | 25% per annum | 14% |

Underlying Stock(s) | BHP, FMG, RIO, WDS | NVDA, MSFT, META, TSLA | BTC |

Strike | 90% | 90% | 90% |

Investment Term | 12 Months | 12 Months | 12 Months |

Settlement Currency | AUD | USD | USD |

Please ensure you read the investment memorandum in full before choosing to invest.

Anadara’s Structured Investments can be easily settled to your preferred wealth management platform or investment reporting platform. Anadara also provides access to its reporting platform for each investor.

Additional Information

Other Documents

General Disclaimer

The content on this site is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. This site is intended for Accredited/Sophisticated/Wholesale investors only. By continuing with an investment, you are self-accrediting that you so qualify. To the extent permitted by law, neither PrimaryMarkets, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment opportunities on this site and any statements made about them by their issuers are not vetted or verified by PrimaryMarkets. Investing in securities in private or unlisted companies and Funds is speculative and involves a high degree of risk. The investor must be prepared to withstand a total loss of their investment. We strongly encourage the investor to seek independent financial, professional or investment advice before investing in securities. The presence of an investment opportunities on this site should not be interpreted as an implied endorsement of it by PrimaryMarkets. Some content provided may constitute a summary or extract of another document. Past performance does not necessarily indicate future performance. The content on this site was current as at date of initial publication but may not be current as at the date of your viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

Want to learn more?

Fill in the expression of interest form below