Capital Raising

CLOSED

Anadara

US Equities Series 3:

Big Tech Companies

INDUSTRY

Financial Services

RAISING

Uncapped

MINIMUM INVESTMENT

$25,000

Investment Highlights

Company Overview

Transaction Overview

News

Transaction Summary

Anadara

Uncapped

Minimum Investment $25,000

Investment Highlights

Fixed Coupon: 24% per annum (paid monthly)

Underlying Stocks: NVDA, MSFT, META, TSLA

Strike Price: 90%

Investment Term: 6 months

Settlement Currency: US Dollars (USD)

Company Overview

The recent performance of the SP500 has been marked by a mixture of resilience and volatility. Throughout 2023 and into 2024, the index has navigated a challenging environment characterised by high inflation, aggressive interest rate hikes and concerns about a potential economic slowdown. Despite these headwinds, the SP500 has demonstrated surprising strength, buoyed by the technology sector. With big tech stocks pushing the SP500 to recent highs, many investors are expecting large tech stocks to pull back. Add to this the pending US Election which is expected to bring an increase in volatility to US markets, it can be difficult for investors to decide when to invest in the market.

For investors that would prefer to be invested in the stock market need to decide if they invest now and risk a near-term pullback or wait on the sidelines and risk missing out on further gains.

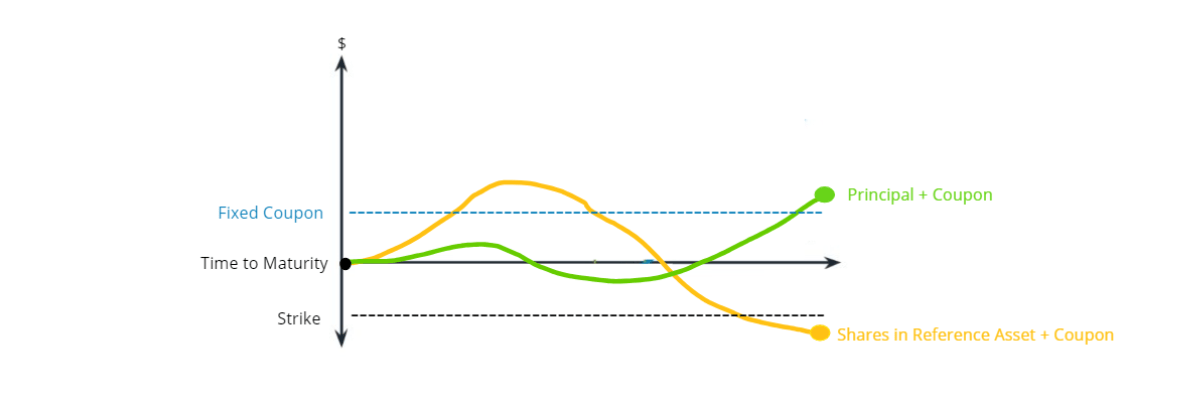

Strategic Yielding Notes offer the best of both worlds, a high yielding note that pays regular income and only converts to equity if one of the underlying stocks falls below the Strike Price over the Investment Term. If all four Underlying Stocks are trading above the Strike Price at Maturity, investors receive their principal investment back.

Anadara is pleased to present investors with the second series of their Strategic Yielding Notes. This series is linked to four of the largest tech companies in the world and includes the following features:

- Fixed Coupon: 24% per annum (paid monthly and adjusted for FX changes)

- Underlying Stocks: NVDA, MSFT, META, TSLA

- Strike Price: 90%

- Investment Term: 6 months

- Settlement Currency US Dollars (USD)

Investors will receive a fixed coupon*, which is paid monthly during the Investment Term. At Maturity, investors either receive their Principal Investment back as cash*, or their Principal Investment will be used to buy shares in the worst performing Underlying Stock if they’re trading below the Strike Price at Maturity.

* All Coupons and the Principal Investment Amount are subject to any movements between AUD and USD during the Investment Term.

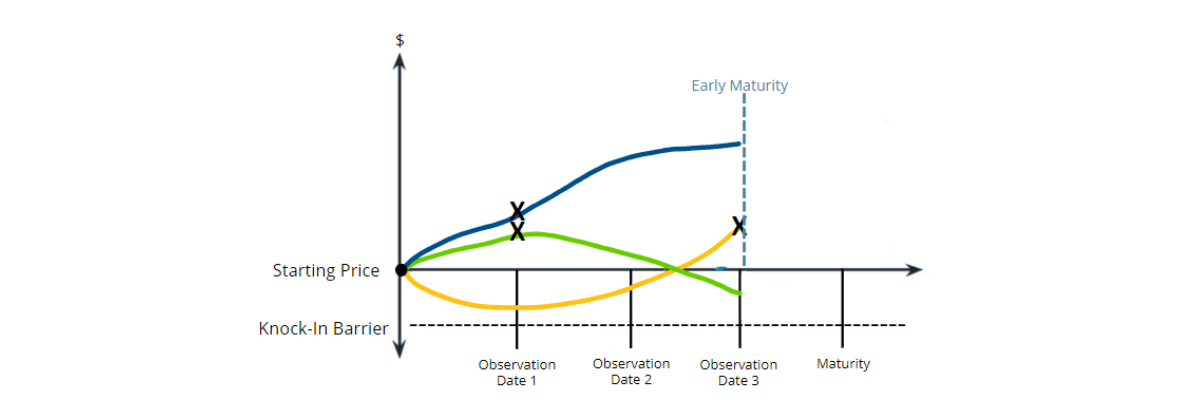

There is also the possibility of early maturity memory feature - if all four underlying stocks have traded higher than their Starting Price on any of the Observation Dates, the investment will Mature early – investors will keep all Coupon payments they received between the Commencement Date and the early Maturity Date, plus they will receive their Principal Investment back as cash*.

This investment may suit investors that would prefer to be invested in the market, particularly in one of the Underlying Stocks, but fear the market will fall during the investment term. This investment provides regular, monthly income* until Maturity, regardless of how volatile the Underlying Stocks are performing.

All coupons and returns associated with this offer are exposed to currency risk – any changes between the AUD and USD will have an impact on returns. Please consult your Adviser before deciding to invest in this product.

INVESTMENT STRUCTURE

Features

Anadara Strategic Yielding Notes Series 2

Reference Assets

NVDA, MSFT, META, TSLA (Share Basket)

Fixed Coupon

24% per annum

Strike

90%

Memory Feature

Yes

Minimum Investment Term

3 months

Maximum Investment Term

6 months

Offer Open Date

6 September 2024

Offer Close Date

20 September 2024*

Funds Due Date

20 September 2024*

Commencement Date

27 September 2024*

Observation Dates

(2024) 27 December*

(2025) 27 January, 27 February*

Maturity Date

27 March 2025*

Settlement Date

10 Business Days after the Maturity Date, or such other date as determined by the Issuer in its discretion as is reasonably necessary for the Issuer to fulfill its obligations under the Terms.

Settlement Currency

US Dollars (USD)

Minimum Investment Amount

10,000 Units at the Issue Price of $1.00 per Unit

Transaction Overview

Terms of offer:

Strategic Yielding Note with a 24% pa coupon linked to NVDA, MSFT, META and TSLA with a lookback memory feature and early maturity possibility.

Use Of Funds: 100% buy notes

General Disclaimer

The content on this site is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. This site is intended for Accredited/Sophisticated/Wholesale investors only. By continuing with an investment, you are self-accrediting that you so qualify. To the extent permitted by law, neither PrimaryMarkets, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment opportunities on this site and any statements made about them by their issuers are not vetted or verified by PrimaryMarkets. Investing in securities in private or unlisted companies and Funds is speculative and involves a high degree of risk. The investor must be prepared to withstand a total loss of their investment. We strongly encourage the investor to seek independent financial, professional or investment advice before investing in securities. The presence of an investment opportunities on this site should not be interpreted as an implied endorsement of it by PrimaryMarkets. Some content provided may constitute a summary or extract of another document. Past performance does not necessarily indicate future performance. The content on this site was current as at date of initial publication but may not be current as at the date of your viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

Want to learn more?

Fill in the expression of interest form below