Capital Raising

OPEN

Electro Venture Holdings

Advancing Sustainable Innovation

INDUSTRY

Energy & Renewables

RAISING

A$30M

PRE-MONEY VALUATION

A$119M

MINIMUM INVESTMENT

A$250,000

Investment Highlights

Company Overview

Products & Services

Transaction Overview

Team

Transaction Summary

Electro Ventures

Raising A$30M

$119M Pre-Money Valuation

$250,000 Minimum Investment

Investment Highlights

The overlapping s-curve investment thesis maximizes return on investment

Electro Ventures is entrepreneur led, so we understand the challenges of starting/building companies

Providing value-add gains as strategic investors, so we’re able to secure better deals

Electro Ventures has a diverse environmental, social and governance portfolio for lower risk

Maximizing ESIC eligibility in their investments for the best tax benefits

Electro Ventures does not charge conventional 2% annual and >20% on capital gains venture capital fees

Some of the top performing portfolio companies are:

- Perth Solar Force, leading the residential solar installing industry in WA, paying healthy repeatable fortnightly drawings to help cover overheads.

- ENAUTIC revolutionizing the watercraft industry with its patented eFoil propulsion technology.

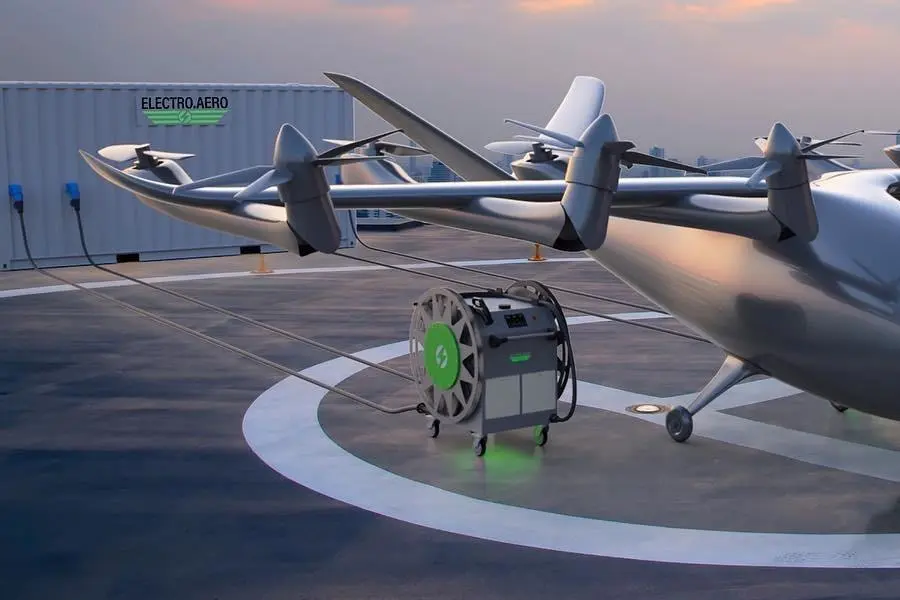

- Electro.Aero is leading the electric aviation charging industry.

- FlyOnE leading the operations and sales of electric aircraft in Australia, who recently raised over $1m at a $54m valuation.

Company Overview

Electro Venture Holdings Pty Ltd (EVH) serves as an investment holding company, to federate several appealing businesses operating in Australia's sustainability sector. The company has cultivated valuable IP, deployable across its portfolio companies. To enhance these entities, EVH has assembled a team of highly experienced executives committed to extracting exponential value.

Within its portfolio, EVH has pinpointed companies exhibiting robust growth potential. A notable instance is ENAUTIC, a hydrofoil watercraft company that has rapidly amassed a significant order book, which grew 4x in value within 9 months of EVH investing $500k.

Fly On E has also been an excellent investment success story, with $200k asset finance against the Electro Alpha aircraft and a $50k investment for 20% equity, the company raised over $1m this year at $54m valuation, so our equity is now worth over $10m, representing more than 200x valuation growth in less than 12 months!

Excitingly, we anticipate a future powered by electrification and believe we can select to fund the highest growth, value-add technology companies in this industry, to maximize our portfolio growth.

Product Portfolio

The majority of our portfolio companies are focused on sustainable mobility in air and on water, like electric aircraft in Fly On E and eFoil watercraft in ENAUTIC snd AquaFlights, but we also have key sustainable energy infrastructure companies, such as Perth Solar Force, Electro.Aero and Electro Base.

Previous Funding

Closed two rounds of capital already with this over 10% of current round already subscribed.

Share Price | Round Opened | Round Closed | Round Settled | |

|---|---|---|---|---|

10c | 31/03/2023 | 07/04/2023 | 30/04/2023 | $5,940,000 |

20c | 28/04/2023 | 31/12/2023 | 31/12/2023 | $1,975,000 |

25c | 30/06/2024 | $3,216,580 |

Transaction Overview

Raising up to A$30M on a Pre-Money valuation of A$119M

Offer Price of A$0.25

Over A$3M raised to date

Use of Funds

enautic waveflyer design for production engineering | electro.aero flip into us delaware c corp for us raising | acquire more shares in perth solar force |

|---|---|---|

25%

Fill Counter

| 25%

Fill Counter

| 50%

Fill Counter

|

News

Joshua Portlock named APAC Entrepreneur of the Year 2025 for Aviation Charging Solutions

Joshua Portlock, Co-Founder and CEO of Electro.Aero, has established himself as a leader in sustainable aviation and electric propulsion technologies. With a background in mechatronic engineering and aerospace automation, he has built multiple ventures focused on advancing electric aviation, hydrofoil watercraft, and sustainable energy solutions.

Recognizing a gap in Australia’s CleanTech investment landscape, Portlock founded Electro Ventures—an investment vehicle designed to back multiple sustainable innovation companies under a single portfolio. His ventures include Electro.Aero (electric aviation chargers), ENAUTIC (electric hydrofoil watercraft), and Aqua.Flights (eFoil surfboards), among others. Unlike U.S. startups that often secure venture capital, Portlock has bootstrapped his businesses, focusing on revenue generation and strategic investment from angel investors and corporate backers.

Looking ahead, Portlock aims to expand Electro Ventures’ assets under management into the billions, positioning the firm as a leading CleanTech investor while continuing to support climate tech founders. His expertise and ability to scale sustainable solutions make Electro Ventures a compelling investment opportunity for those interested in clean energy, sustainable transportation, and breakthrough electric propulsion technologies. Read More

.General Disclaimer

The content on this site is provided solely for information purposes, is not a recommendation or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. This site is intended for Accredited/Sophisticated/Wholesale investors only. By continuing with an investment, you are self-accrediting that you so qualify. To the extent permitted by law, neither PrimaryMarkets, its affiliates, nor the content providers (such as the issuers of securities who appear on the site) are responsible for any investment decisions, damages or losses resulting from, or related to, the content, data and analyses or their use. The investment opportunities on this site and any statements made about them by their issuers are not vetted or verified by PrimaryMarkets. Investing in securities in private or unlisted companies and Funds is speculative and involves a high degree of risk. The investor must be prepared to withstand a total loss of their investment. We strongly encourage the investor to seek independent financial, professional or investment advice before investing in securities. The presence of an investment opportunities on this site should not be interpreted as an implied endorsement of it by PrimaryMarkets. Some content provided may constitute a summary or extract of another document. Past performance does not necessarily indicate future performance. The content on this site was current as at date of initial publication but may not be current as at the date of your viewing. For a more complete understanding of all the terms and conditions of your use of this site click here.

Want to learn more?

Fill in the expression of interest form below