Capital Raising

CLOSED

Marina Bay Capital

Holistic Corporate Finance &vCorporate Development Advisory Services

INDUSTRY

Financial

Investment Highlights

Company Overview

Transaction Overview

Additional Information

Team

Marina Bay Capital

This offer closed March 2023. If you would like to discuss anything in relation to this company please contact us for further information.

All information on this page was current as at the date of closure.

Investment Highlights

Specialised Corporate Finance Advisory

Global Network

Wide-Ranging Collaboration

Strongly Positioned to Achieve High Growth

Company Overview

Marina Bay Capital (MBC) takes great pride in being an essential part of a business’s success.

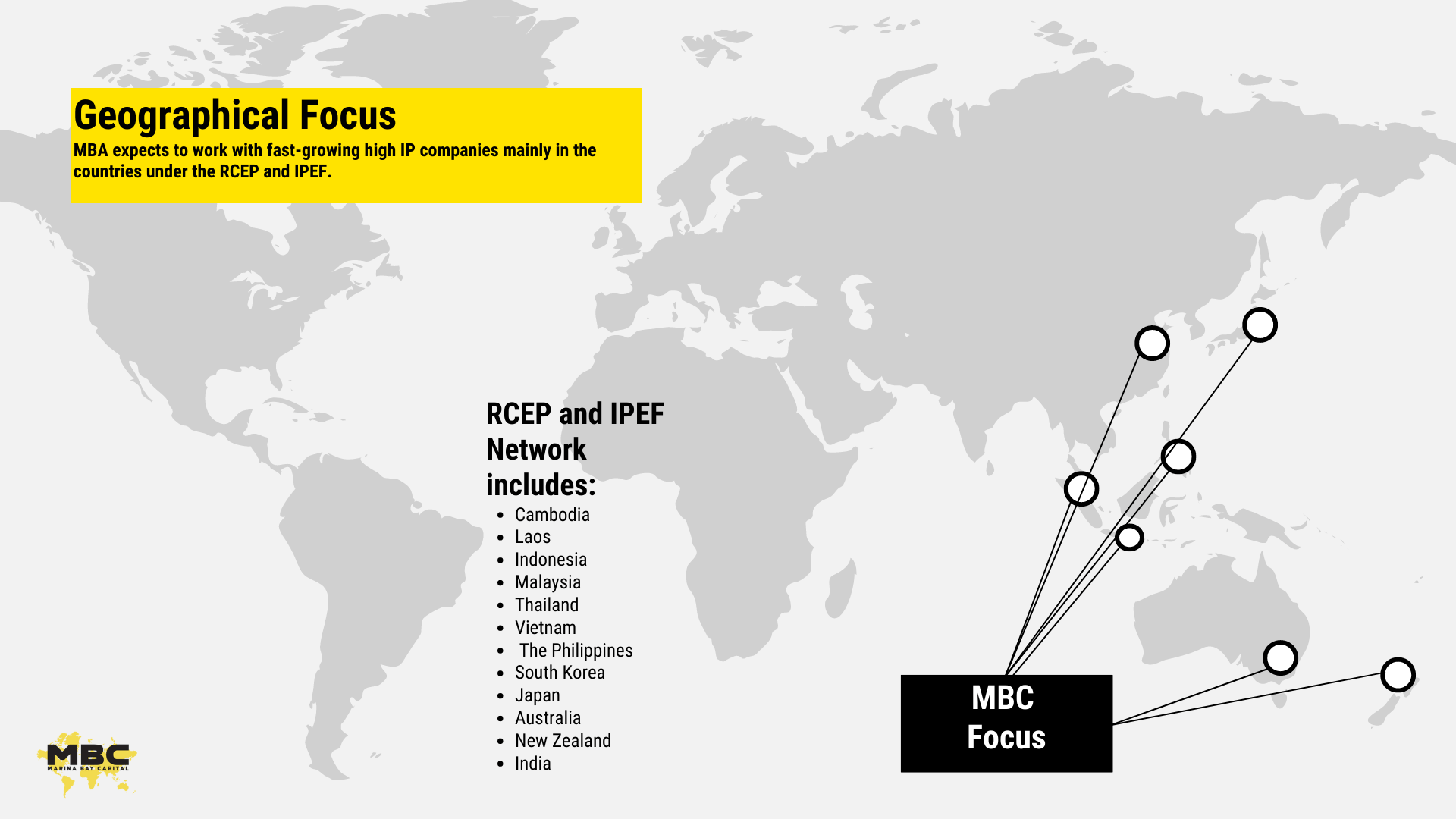

MBC’s global network facilitates connections for companies seeking equity or debt capital and provides foundational strategies and specialized assistance to deliver maximum return for clients, investors, and stakeholders.

Our priority is companies engaging in the future economy products & services, such as artificial intelligence, agri-tech, blockchain, big data and cloud, green businesses, renewable energy, battery metals, fintech, med-tech, prop-tech, and healthcare.

Key customer criteria include companies that have an Environmental, Social, and Governance (“ESG”) focus.

MBC Startegic Partners

Key Opportunities for MBC

NYSE & Nasdaq exploring IPO pipelines in RCEP* Market as Chinese listings dry up

NYSE & Nasdaq exploring IPO pipelines in RCEP* Market as Chinese listings dry up

Singapore & NYC Exchanges announcements

Collaboration on dual listings and work together in a number of other key areas focused on capital markets

Attractiveness of developing economies as investment destinations

RCEP a market of 2.2 billion people and US$26.2T (30% Global GDP)

Growth in Green Technology/Renewables/Infrastructure

Advancements are expected to present an opportunity for growth in 2022/23

Bloom of the SPAC market in Asia

SGX’s SPAC framework stands out from other bourses, with its enhanced investor protection mechanisms

MBC Dividend

MBC’s operating expenses are extremely low relative to its peer investment banking services firms, and the Company’s founders strongly believe stakeholders and operators should be rewarded with profits of the company through dividend distribution on a regular basis.

In line with the founder’s vision, the Board may recommend a dividend to shareholders of no less than 50% of the net profit after tax once per year with a goal of bi-annual distributions by 2024.

Want to learn more?

Fill in the expression of interest form below