Why would a company want to IPO on the ASX?

There are 3 fundamental reasons why a company would want to IPO on the ASX:

- Raise new equity capital,

- Provide liquidity for shareholders; i.e. a marketplace to buy/sell securities, and

- Diversify their shareholder base.

Sometimes companies are criticised for going public via an IPO too early, or because they misused money raised at IPO. Companies may even lack the skills to manage the stock exchange’s disclosure obligations. In a widely regarded book, “The Intelligent Investor”, Benjamin Graham wrote:

“In every case, investors have burned themselves on IPOs, have stayed away for at least two years, but have always returned for another scalding. For as long as stock markets have existed, investors have gone through this manic-depressive cycle.”

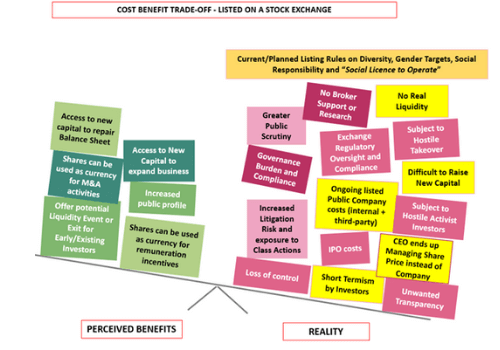

The reality of being listed on a traditional Stock Exchange is often very different from the expectations, as seen below.

What challenges can a company listing via an IPO face?

Companies seeking to list on a traditional Stock Exchange should closely examine the reality or becoming and remaining listed. There is no guarantee of raising new capital or sourcing liquidity for a robust, supportive, long-term shareholder base. It is important to consider many other issues that a listed company faces:

Listed companies can face

- High IPO Costs: The cost to IPO and remain listed on the ASX can be high, especially for small companies. Costs include up to $1M for listing and $500,000 p.a. for annual fees, compliance and financial reporting, etc.

- Fragmented Market: Over 75% of companies listed on the ASX have a market capitalisation of less than $2.9M. They struggle for market relevance, broker support and liquidity.

- Additional Resources: Publicly listed companies need to add costly infrastructure and overheads to comply with Listing Rules. These include continuous disclosure, audit and information transparency. Importantly, senior management of listed companies can be too focused on short-term share price movements rather than the long-term success of the company.

- Strategic & Operational Focus: Publicly listed companies often alter their focus to align with financial and operational announcements to the market. This can be high-maintenance and, at times, detrimental. If a Board and management alter their behaviour, decision-making and execution to minimise the adverse impacts of announcements, rather than what is best for the business it can be damaging.

- Shareholder Activism, Class Actions and Takeovers: Publicly listed companies attract undue attention from shareholder activists, short sellers, litigation-funded class actions and opportunistic takeover offers. These distract management’s attention from the underlying business.

- Diversity, Gender Targets, Social Responsibility and Social Licence to Operate: Stock Exchanges are increasing their influence over what types of businesses can list and how a companies operate. In relation to diversity, gender targets, social responsibility and the ‘social licence to operate’, exchanges have more influence. These controls may alter the focus and operation of businesses and increase the risk of litigation for non-compliance.

So are private markets the new public markets?

Traditionally, the fragmented private market has left little opportunity for investors to get involved with private companies and no real alternative for companies to delay going public via n IPO.

PrimaryMarkets has developed a global Trading Platform that solves a many issues that historically limited private markets. It gives founders, shareholders and companies an alternative to an IPO. By listing their private company on PrimaryMarkets they enable the open transaction of shares that gives many of the benefits of a traditional IPO.

The benefits of listing on PrimaryMarkets rather than an IPO

- Flexible Share Trading Rules: These are fully customisable to suit a company’s needs

- Low-Cost Listing: The costs of listing and remaining listed are much lower than traditional stock exchanges

- Investor Resources: All company information including financials, investor presentations, research notes, press releases etc that give investors relevant company and investment information

- Global Investor Network: Access to PrimayMarkets global Investor network of over 110,000+ potential sophisticated investors

- Transaction Controls: Timing, conditions of sale and access to trading in the company’s shares can be controlled by the company

- Transparency: Full management oversight and monitoring of transactions and processes for settlement and share registration services

Investors have an opportunity to gain access to fast-growing private unlisted companies with significant wealth creation opportunities that were previously inaccessible.

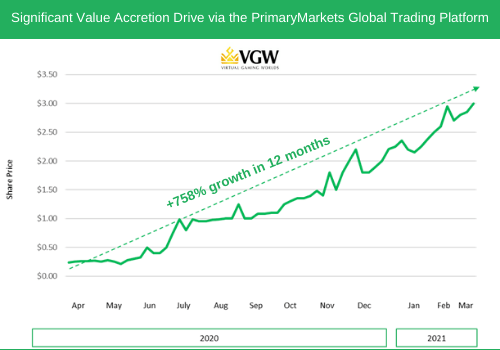

Case Study: How VGW benefits from private trading

Virtual Gaming Word (VGW), an online gaming company founded by one of Australian billionaire Laurence Escalante, experienced very strong share price growth on PrimaryMarkets (graph below). This was driven in part by access to PrimaryMarkets global network of over 110,000 potential investors, including PE firms, family offices and sophisticated investors.

How has VGW performed since listing on PrimaryMarkets

- VGW (Unlisted Public Company) commenced trading on the VGW Private Trading Hub in October 2018, with the first trade at A$0.16 per share.

- VGW has since attracted widespread interest from PrimaryMarkets Members, as well as its existing shareholder base.

- VGW has had a stellar time since listing on PrimaryMarkets jumping 2300% with a last traded price of A$3.83 in September 2022.

- During that time PrimaryMarkets has actively promoted the company to its database of investors and millions of shares in the company have been traded.

You can read the full VGW case study and see how private markets have benefited the company in meeting in business goals.

As the implications of COVID-19 played out and the ASX IPO process becomes protracted and expensive for smaller companies we will see companies delay their IPO. But shareholders will increasingly demand liquidity and private companies will start looking at alternatives to a traditional IPO listing.

Low-interest rates and the search for new capital growth opportunities for investors will become an opportunity for investors and unlisted companies as a new channel for investment.

PrimaryMarkets and other private markets will increasingly become a legitimate alternative for companies seeking the same benefits of an IPO.

If you would like to know more, please visit us and explore how our trading hubs can benefit your private company.